[Français][Russian]

EMBARGO

Not to be released before

Wednesday, 6 December 2000

00:01 GMT

Press Release ECE/GEN/00/28

Geneva, 30 November 2000

Transition Economies: Highest Growth Since the Fall

of the Berlin Wall

UN/ECE releases its second 2000 Economic Survey of Europe

"An unexpectedly strong recovery in

almost all the ECE transition economies marked the first half of 2000, their aggregate GDP

increasing by 6 per cent above the same period of the previous year. In nearly all of them

GDP increased, the first time in 10 years when such a robust economic performance has

pervaded the region" stresses Mrs. Danuta Hübner, Executive Secretary of the United

Nations Economic Commission for Europe (UN/ECE) commenting the latest issue of the Economic

Survey for Europe, just released by the UN/ECE. Both external and domestic factors

underpinned this growth. Strong import demand from western Europe gave a boost to exports

from the transition economies while commodity exporters benefited from higher global

demand and rising commodity prices. At the same time, progress in systemic transformation

(although varying widely among countries) also contributed to the strength of the

recovery, notably in the more advanced transition countries.

Higher growth than expected for 2000 …

During the first half of 2000 the rates of economic growth in the ECE

transition economies have been higher than expected at the end of last year. The

short-term outlook for these countries now looks very favourable for the remainder of 2000

and through 2001. Countries with rapidly growing high-tech industries such as Hungary, and

to a lesser degree the Baltic states and other countries bordering the European Union,

should reap the benefits of growing productive efficiency. The south-east European

transition economies, however, have not benefited much from growth in the high-tech

sectors, but this region can also expect relatively high growth rates, at least in the

short run, thanks to the more favourable external environment which should support a

strengthening of the recovery. The outlook for most of the CIS countries will largely

depend on the situation on the world commodity markets.

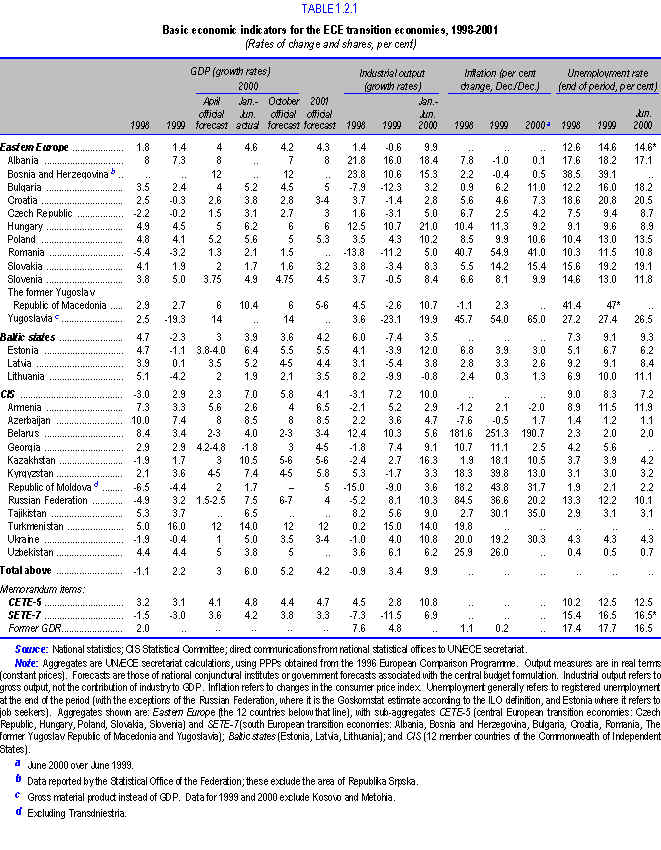

Given the prevailing expectations that these favourable conditions will

continue, many Governments have raised their forecasts for GDP growth in 2000 (see table).

These revisions are especially pronounced in some of the CIS countries, especially Russia,

where in October the official forecast for GDP growth in 2000 as a whole was more than

triple that made at the beginning of the year. Consequently, aggregate GDP in the CIS is

now expected to grow by close to 6 per cent in 2000; eastern Europe is forecast to average

4.2 per cent and the GDP growth in the Baltic states should settle down to 3.6 per cent.

All in all this suggests an average annual rate of growth for the ECE transition economies

as a whole of over 5 per cent, by far the highest rate since the transition process got

underway 10 years ago.

… and sustained growth in 2001 …

The rate of growth of world output is expected to decelerate in

2001, but growth is forecast to remain relatively strong in western Europe and this should

sustain the demand for imports from eastern Europe. Commodity exporters are also expected

to continue to benefit from strong global demand and relatively high world market prices.

The risks of an upsurge of inflation in western Europe appear to be very low and there is

therefore no need for a further tightening of monetary policy which would unnecessarily

threaten economic growth both in western Europe itself and in many of the transition

economies. Most official forecasts for GDP growth in the transition economies in 2001

reflect this optimism. Moreover, while actual performance in the transition economies has

often diverged considerably, the forecasts for 2001 are more homogeneous across countries

and subregions: average growth rates in eastern Europe, the Baltic states and the CIS are

all expected to be slightly above 4 per cent.

In eastern Europe, the general expectations are that the current high

rates of output growth will be sustained. Some of the countries that in recent years have

experienced economic downturns or a deceleration of growth, anticipate a strengthening of

GDP growth in 2001. The improvement of the external environment is behind the expectations

of a continuation of the recovery in the three Baltic countries in 2001. Although the

unusually high rate of output growth in Russia in 2000 is unlikely to be sustained for a

second year, the authorities are still expecting GDP growth of 4 per cent in 2001.

For the rest of the CIS, most of the available official forecasts for GDP growth in 2001

are in the range of 4-6 per cent. It should be borne in mind, however, that the economic

prospects of these countries remain highly sensitive to external shocks and movements in

world commodity prices. In addition, for some of them there still exists a threat of

energy shortages due to supply constraints and high levels of external indebtedness

(mostly to Russia), while access to additional external financing remains uncertain.

… with a slight danger of inflation

Since the recent resurgence of inflation in some transition

economies was mainly imported from abroad, the prospects for inflation will also depend to

some extent on what happens to world commodity prices. So far, high rates of productivity

growth have helped to alleviate these inflationary pressures: industrial unit labour costs

have declined in most of the east European economies as increases in nominal wages have so

far lagged behind the growth in labour productivity. In contrast, relatively slower

productivity growth coupled with an accelerated rise in wages has resulted in rising unit

labour costs in all the CIS countries. In some of them producer price inflation has been

almost double the rate of increase in consumer prices, putting further pressure on

consumer prices and wages to rise even further. Rising real wages can have two different

effects on the short-term outlook of eastern Europe: on the one hand they can boost

consumer demand and hence domestic output but, on the other, they can eventually increase

inflationary expectations. Continued productivity growth and a propitious global economic

environment would favour the first scenario. Rising commodity prices would favour the

second and would likely result in a moderation of growth in 2001 if the central banks

decide to respond by tightening monetary policy.

The balance of payments does not appear to be a constraint on growth in

most ECE transition economies. Significant improvements have occurred in the oil-exporting

CIS countries, but even in the oil-importing countries, exports have been growing

strongly, current account balances have improved and there has been an increase in FDI in

the region. Current forecasts suggest little change in current account balances although

this scenario depends on the continued buoyancy of west European economic growth and a

stabilization of oil prices. Conditions in the financial markets are generally favourable,

and most countries hope to maintain (if not increase) current levels of FDI. However, the

anticipated fall in privatization revenues in some transition economies (such as Poland)

will require a shift to alternative sources of finance.

For further information please contact:

Economic Analysis Division

United Nations Economic Commission for Europe (UN/ECE)

Palais des Nations

CH - 1211 Geneva 10, Switzerland

Tel: (+41 22) 917 27 78

Fax: (+41 22) 917 03 09

E-mail: [email protected]

Website: http://www.unece.org/ead/ead_h.htm

In order to provide you with a better service, we would appreciate it if

you would send a copy of your article to: Information Unit, United

Nations Economic Commission for Europe (UN/ECE), Palais des Nations, Room 356, CH - 1211

Geneva 10, Switzerland,

Tel: +(41 22) 917 44 44, Fax: +(41 22) 917 05 05,

E-mail: [email protected], Website: http://www.unece.org

Thank you. |