[Français][Russian]

EMBARGO

Not to be released before

Wednesday, 6 December 2000

00:01 GMT

Press Release ECE/GEN/00/27

Geneva, 30 November 2000

Western Europe and North America: Economic Situation

Still Very Favourable

UN/ECE releases its second 2000 Economic Survey of Europe

"The current economic situation in Europe and North

America is better than at any time in the last decade." stresses Mrs. Danuta Hübner,

Executive Secretary of the United Nations Economic Commission for Europe (UN/ECE)

commenting the latest issue of the Economic Survey for Europe, just released by the

UN/ECE. "The dynamism of the world economy has stimulated growth in western Europe

via foreign trade and the close links between western and central Europe have similarly

boosted economic growth in the latter."

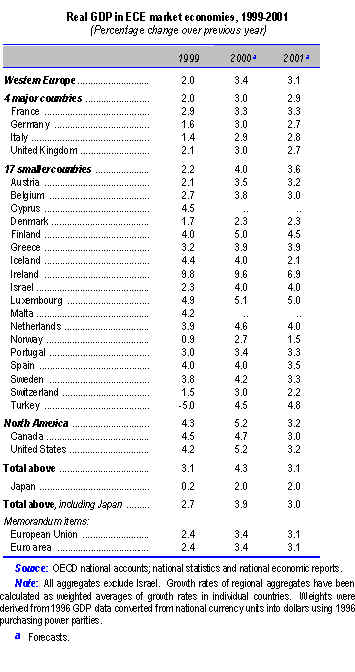

Current forecasts are for a continuation of the cyclical recovery in

western Europe, with real GDP expected to increase by about 3 per cent in 2001, down from

3.4 per cent this year (see table). The growth forecasts are the same for the euro area.

The relatively mild slowdown expected in 2001 reflects the lagged effects of the

progressive tightening of monetary policy and the less supportive global economic

environment, notably the weakening of economic growth in the United States, and the rise

in oil prices. Some offset to these factors will be provided by tax cuts, notably in

France, Germany and Italy. Both private consumption and fixed investment should remain

relatively strong, and exports are expected to continue to be an important source of

growth in 2001. Current forecasts assume that the gains in price competitiveness

associated with the weakness of the euro will be only partly reversed in 2001.

In the United States, the annual growth rate of GDP is expected to slow

down from somewhat more than 5 per cent in 2000 to some 3¼ per cent. This is in line with

the "soft landing scenario" in which growth of actual output in the United

States will fall below the growth of potential output in the continued presence of

moderate inflation. Such a development should allow for an orderly unwinding of the

existing domestic and external imbalances. The slowdown in economic growth also partly

reflects the impact of the progressive tightening of monetary policy. Also the wealth

effect, which has supported private consumption in recent years should weaken, given the

fall in asset prices. This should at the same time lead to some increase in the personal

savings rate.

The short-term economic outlook for the western market economies and

the global economy, however, remains subject to a number of important downside risks,

which have not diminished in recent months. These risks originate largely in the

considerable imbalances which have built up in the United States economy and which, in

turn, are reflected in the strong dollar. As a result, the possibility of a hard landing

– involving sharp falls in share prices and the dollar – cannot be discarded.

Such an outcome would, of course, lead to adverse spillovers in the rest of the world

economy. The unexpectedly large increase in international oil prices, moreover, has

further increased the uncertainty surrounding the international economic outlook. Current

forecasts assume that the high level of oil prices will not be sustained in 2001 and that

they will fall back to the OPEC target range of $22-$28 per barrel. Sustained high oil

prices, however, would lead to a stronger than expected dampening of economic growth and

increase the risk that wage earners will demand higher wages to offset the losses in their

real incomes. This could trigger a wage-price spiral and a much more restrictive monetary

policy than currently anticipated, with subsequent negative effects on levels of economic

activity. But there are as yet no signs of such second-round effects in the labour

markets.

"In fact, given that the oil price will fall back as from spring

2001 and that the euro will appreciate somewhat against the dollar, assumptions of

virtually all current forecasts, inflation in the euro area should ease towards the

ECB’s 2 per cent ceiling in 2001" concludes Mrs Hübner. "Therefore

there does not appear at present to be any need for a further tightening of monetary

policy, which, in fact, would pose an unnecessary risk to economic growth. Indeed, the

rise in oil prices is not inflationary per se; it constitutes, rather, a one-off

increase in the domestic price level, which should be accommodated by monetary

policy".

For further information please contact:

Economic Analysis Division

United Nations Economic Commission for Europe (UN/ECE)

Palais des Nations

CH - 1211 Geneva 10, Switzerland

Tel: (+41 22) 917 27 78

Fax: (+41 22) 917 03 09

E-mail: [email protected]

Website: http://www.unece.org/ead/ead_h.htm

In order to provide you with a better service, we would appreciate it if

you would send a copy of your article to: Information Unit, United

Nations Economic Commission for Europe (UN/ECE), Palais des Nations, Room 356, CH - 1211

Geneva 10, Switzerland

Tel: +(41 22) 917 44 44, Fax: +(41 22) 917 05 05,

E-mail: [email protected], Website: http://www.unece.org

Thank you. |