[RUSSIAN]

EMBARGO

Not to be released before

Wednesday, 3 May 2000

00:01 GMT

Press Release

ECE/GEN/00/17

Geneva, 26 April 2000

2000: Economic Growth All

Over

UN/ECE releases its first 2000

Economic Survey of Europe

For the first time

since 1990, average GDP growth for the year 2000 in western Europe is likely to exceed 3

per cent; for the transition economies of eastern Europe growth should return to an

average of 4 per cent or more, and the Baltic economies should emerge from recession with

an average growth rate of some 3 per cent. After a much better than expected outcome in

1999, growth is also likely to continue in Russia and the other CIS countries, although

here the prospects are more uncertain. This improved outlook for the European economies is

also set against a background of more optimistic forecasts for other parts of the world

economy and, not least, for continuing growth in the United States where, although a

slowdown is currently forecast, GDP is still expected to increase by some 4 per cent in

2000. These forecasts are among the issues discussed in the latest Economic Survey

for Europe, just released by the United Nations Economic Commission for Europe

(UN/ECE).

"However, it is important to stress

two points" says Paul Rayment, Director of the Economic Analysis Division of the

UN/ECE, "first, there is always a distribution of risk surrounding any forecast and

although this Survey believes the balance is now more favourable for growth in

Europe this does not mean that the downside risks are negligible; the possibility of a

crash in overvalued equity prices in the United States is a serious risk to the current

outlook, and there are uncertainties over the course of oil prices and of monetary policy

in the EMU. Secondly, not all the economies of the region enjoy the same prospects and

there are especially large differences among the transition economies. In particular much

of the region of south-east Europe is still beset by severe structural problems and the

consequences of several armed conflicts which have made the process of transition to a

market economy much more difficult than in central Europe."

Western Europe and North America

Highest expansion in

2000 since the early 1990s …

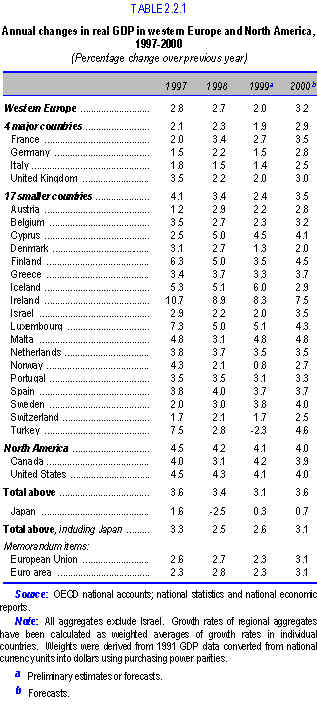

Against a background of improving

economic conditions in other regions of the world economy, the short-run economic outlook

for western Europe and North America is now quite favourable. In western Europe, the

cyclical recovery is expected to gain further momentum in the course of 2000, with real

GDP currently forecast to increase by slightly more than 3 per cent in 2000 (table 2.2.1).

This would be the largest increase since 1990, when there was a growth rate of 3.4 per

cent. In fact, in the absence of the downside risks discussed in the Survey a

somewhat stronger rate of growth than currently expected in Germany and Italy, the outcome

could be even better, possibly closer to 3.5 per cent. Performance in the euro and

non-euro areas of western Europe is expected to be similar. In the United States, the

consensus of forecasts is for the cyclical expansion to slow down from the high rates of

the final two quarters of 1999. Average annual growth in 2000 could still be some 4 per

cent, which includes, however, a significant statistical carry-over effect from 1999.

Broadly the same outlook is forecast for Canada. These forecasts imply a significant

narrowing of the growth differential between North America and western Europe in 2000.

This benign scenario could continue into 2001, especially if the cyclical upturn in the

various regions of the world economy leads, via the foreign trade channel, to a mutually

reinforcing process of economic growth.

… due to rapid expansion of

exports in western Europe …

In western Europe, the main

factor behind the strengthening recovery is likely to be the more rapid expansion of

exports. Apart from rising intraregional trade, this largely reflects the stronger demand

from emerging markets and developing countries where the rate of economic expansion is

also forecast to accelerate. Such a favourable export performance will contribute to the

strengthening of domestic demand. Private consumption will be supported by rising real

incomes, in turn the result of further gains in employment and higher real wage rates.

Business investment should be stimulated by rising capacity utilization rates and improved

sales prospects. Changes in stockbuilding will also make a small contribution to higher

output growth. The stronger growth of domestic demand, however, will lead to a rising

demand for imports and the change in real net exports should be broadly neutral in its

effect on economic growth in 2000. Among the four major economies, France and the United

Kingdom are likely to develop the strongest cyclical momentum, but growth is also

accelerating in Germany and Italy, where the business climate improved markedly in early

2000. Italy, nevertheless, is expected to continue to grow more slowly than most of the

other west European countries. The rate of economic expansion will remain quite strong in

the smaller west European economies.

Higher levels of economic activity in

western Europe will not only feed through to employment but should also lead to a further

decline of the unemployment rate. Inflation is expected to pick up slightly, a main

underlying assumption being that the rise in oil prices will peter out in the spring and

possibly be partly reversed later on in the year. Growth in labour costs is expected to

remain relatively moderate and to be largely offset by productivity gains. Fiscal policy

is set to maintain a broadly neutral stance, but many forecasters expect that the cyclical

upturn will lead to a further gradual tightening of monetary policy both in the euro area

and in the United Kingdom in order to meet the established inflation targets.

… and robust private consumption and business

fixed investment in the United States

In the United States, robust

private consumption and business fixed investment are likely to remain the mainstays of

economic growth, partly supported by continuing positive wealth effects. Exports are

expected to strengthen as a result of the more favourable international economic

environment. A slowdown in employment growth and less favourable financing conditions

associated with the tightening of monetary policy, however, should tend to dampen the

growth of household expenditures and fixed investment. Import demand should remain strong

but the changes in real net exports is likely to be considerably less of a drag on

domestic activity in 2000 than in the two preceding years. In view of the continuing

strength of economic growth, the unemployment rate should stay close to 4 per cent.

Inflationary pressures are still expected to remain rather moderate, given the assumptions

about developments in the oil markets and that increases in productivity should continue

to largely offset increases in labour costs. The slowdown in the rate of expansion in the

course of 2000 should bring the growth of demand somewhat closer to the lower rate of

potential output growth. This gradual transition of the economy towards a "soft

landing" has already been forecast for the last few years, but the continuing

strength of the cyclical upturn has been systematically underestimated.

Transition economies:

generally favourable short-term prospects …

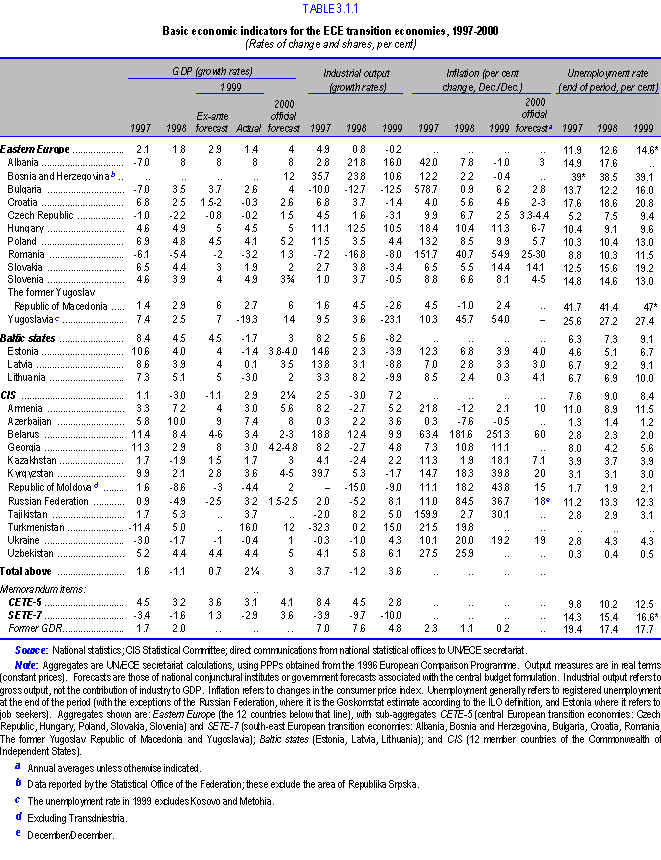

The short-term

prospects for the transition economies at the beginning of 2000 are now considerably

better than they were in the middle of last year. Both domestic conditions (notably the

recovery of output and the improvement in domestic demand) and the external environment

(dominated by the cyclical upturn in western Europe) are much more favourable than they

were in 1999. The available official forecasts suggest that the governments in practically

all the transition economies expect positive GDP growth in 2000 and in most cases an

acceleration of the economic recovery (table 3.1.1). GDP in the ECE transition

economies as a whole should increase on average by some 3 per cent in 2000, which would

represent a record rate of growth for the region as a whole. Growth in eastern Europe is

expected to average close to 4 per cent; in the Baltic states the expectation is for an

average 3 per cent; and in the CIS countries as a whole, GDP could increase by more than

2 per cent.

The official GDP forecasts shown in table

3.1.1 are in many cases (especially in eastern Europe and the Baltic states) those

incorporated in the draft budgets for 2000 and in most cases were prepared in late 1999

when the strength of the incipient recovery was still not clear; consequently, some of

these forecasts may now be somewhat conservative. Indeed, the acceleration of the recovery

of output in some countries during the first months of 2000 (particularly in Hungary and

Poland) has already led to upward revisions of some of the forecasts.

In any case, strong and steady economic

growth can be expected to continue in Hungary, Poland and Slovenia, and these economies

are likely to preserve their leading positions in the ranking of east European growth

rates. The expected 2 per cent GDP growth in Slovakia reflects the continuation of a

cautious adjustment effort after the authorities abandoned an unsustainable expansionary

course in late 1998. In recent years, similar adjustments in Croatia and especially in the

Czech Republic have led to economic downturns. The authorities in both these countries

expect positive rates of GDP growth in 2000, although these are likely to remain

relatively low. An economic upturn is expected in the three Baltic states as well, but

their rates of growth are unlikely to return to those prevailing before the Russian

crisis.

After a generally weak performance in

recent years, the governments in a number of south-east European transition economies

(Albania, Bosnia and Herzegovina, Bulgaria, The former Yugoslav Republic of Macedonia and

Yugoslavia) expect relatively high rates of GDP growth in 2000. But even if these

forecasts materialize, in most cases they will only reflect recovery from a very low base;

the return of this region to sustained and high rates of economic growth still requires

major restructuring and large-scale new investment. In Romania, economic activity is

likely to remain weak in 2000 (the government expects only 1.3 per cent GDP growth). The

persistent macroeconomic imbalances in this country leave little room for economic policy

to manoeuvre, making strong growth unlikely in the short run.

… with fragile recovery in

Russia

The current recovery in Russia

hinges on a fragile equilibrium which is based on the post-crisis gains in competitiveness

(thanks to a large depreciation in the real exchange rate and a fall in real wages)

coupled with favourable external conditions (in the first place, high oil prices). The

economy remains highly vulnerable to a reversal in any of these conditions (for example, a

fall in oil prices); hence, the short-term economic outlook for Russia still remains

rather uncertain. Nevertheless, at present the Russian authorities are quite optimistic as

regards the short-term economic outlook. According to the budgetary projections, GDP is

expected to grow by some 1.5 to 2 per cent in 2000, and some Russian officials have

recently suggested that the rate of growth could be even higher.

Recovery in Ukraine has been underway

since the third quarter of 1999 and has continued during the first months of 2000.

However, in Ukraine, the uncertainties regarding the short-term outlook are probably even

greater than in Russia: if the authorities manage to avert a looming foreign debt crisis,

GDP might grow faster than envisaged in the official forecast (1 per cent for 2000); but

in the event of a debt crisis, the economy may sink back into recession. In Belarus, after

the setback caused by the Russian crisis, the authorities have set a relatively modest

growth target for 2000, which they hope to support with a new, export-oriented policy. The

return of the Republic of Moldova’s economy to growth will largely depend on the

success of a policy adjustment initiated by the government, the implementation of which

will also be a pre-condition for the resumption of IMF financing.

In general, the authorities in most of the

other CIS countries have set rather ambitious targets for 2000: GDP growth is envisaged to

accelerate in all the Caucasian economies as well as in most of the central Asian CIS

countries. The government of Turkmenistan is forecasting double-digit growth rate in 2000

but this will largely depend on success in increasing exports of gas. After a change in

policy in 1999, growth resumed in Kazakhstan in the second half of the year and the

economy appears poised to continue to grow in 2000 as well. It should, however, be noted

that in Kazakhstan (as well as in most of the other central Asian economies) the

relatively good GDP outcome for 1999 was largely due to an unexpectedly good harvest;

whether this can be repeated in 2000 remains to be seen.

The outlook for inflation in 2000 remains

quite favourable in most of the transition economies. In preparation for EU accession,

policy makers in Hungary and Poland are targeting further large cuts in the rate of

inflation in 2000. Lower inflation is also envisaged in Slovenia, after the minor price

shock caused by the introduction of VAT in 1999. In Slovakia the inflation rate is

expected to remain in double-digits, mostly reflecting the on-going process of

liberalizing regulated prices. The authorities in Romania are aiming at a substantial

reduction in the rate of inflation but it is still likely to remain among the highest in

eastern Europe. Inflation in the Baltic states in 2000 should remain within the range of

3-4 per cent, while in all the CIS countries for which such forecasts are available

inflation in 2000 is expected to be lower than in 1999.

… and more uncertainties in

South-East Europe

" The economic situation in

south-east European countries -- Albania, Bosnia and Herzegovina, Bulgaria, Croatia,

Romania, The former Yugoslav Republic of Macedonia, Yugoslavia -- remains very

fragile" stresses Paul Rayment, Director of the UN/ECE Economic Analysis Division. "The problem of the slow disbursement of committed funds will have to be overcome

– essentially by the donor countries - if we want a quick start to many projects and

a general improvement in expectations."

Although, the direct impact of the Kosovo

conflict was less than feared earlier in 1999, the damage was still significant and the

economies of south-east Europe moved from modest GDP growth in 1998 (1.3 per cent) into

recession (about -3 per cent). The improvement forecast for 2000 is largely a recovery

from this recession rather than the first signs of sustained economic growth. The current

account deficits have been large and persistent, with a consequent build-up of foreign

debt, unemployment rates average nearly 17 per cent, much higher than in central Europe,

and in conjunction with widespread job insecurity and discontent with living standards,

this makes it difficult to implement reforms that might worsen the social situation still

further in the short run. Domestic investment remains weak and foreign investment is not

attracted to the region in any significant quantity.

International efforts to assist the

economies of south-east Europe are now extensive but it is becoming increasingly clear

that they suffer from many of the same problems that have beset the assistance efforts to

most other transition economies ever since 1989. First, there is a large gap

between promises to provide assistance and its actual disbursement – this delays

action and creates disillusion in the region. Secondly, there is poor coordination

between the 29 countries and international organizations belonging to the Stability

Pact – resources are widely dispersed and inadequately coordinated both between

donors and with national programmes. Thirdly, there is also a confusion of

conceptual frameworks and approaches, and it is by no means obvious that the essential

differences between the trio of problems – development, transition and postwar

reconstruction – are clearly recognized. There is also a tendency for donors to

promote separate projects without placing them within a broader programme of development;

and sometimes projects reflect more the interests of their promoters than those of the

recipient countries.

The need for individual countries in

south-east Europe to draw up their own programmes for transition and development, which

would accurately reflect their specific problems and preferences, is one of the lessons

which this Survey has previously drawn from the highly successful Marshall Plan of

the late 1940s. These national programmes would then be discussed in a regional framework

to improve coordination, and to encourage cooperation wherever there are international

public goods, economies of scale and other externalities to be found.

The regional dimension is certainly

important and for a number of reasons. The very fact of increased efforts at regional

cooperation is a sign of increasing stability and security in the region and, as such, an

important step towards attracting foreign investment. But cooperation to remove trade

barriers and other obstacles to doing business across the region would also help to

overcome the difficulties of trying to attract FDI to a collection of small, low income

and fragmented markets. If foreign direct investors can envisage supplying a regional

market instead, the incentives to invest in the region are greatly increased; this will be

even more the case if the EU were to move quickly to remove all trade barriers to imports

coming from south-east Europe. Regional cooperation can also make it easier to deal with

black markets, organized crime and other activities which are subversive of market and

democratic institutions. The failure to deal effectively with these and other matters is

one reason why some of the better placed countries in the region are more keen to

disassociate themselves from "the Balkans" and seek directly closer bilateral

links with the EU.

The problem of coordinating national

programmes of development still needs to be addressed, and although a quick start to many

projects is crucially important there should be no illusions that the basic task, the

economic regeneration of the region, can be accomplished quickly. For western Europe, and

the EU in particular, the pursuit of economic regeneration and of stability and security

in the region will have to be a long-term commitment.

For further information please contact:

Economic Analysis Division

United Nations Economic Commission for Europe (UN/ECE)

Palais des Nations

CH - 1211 Geneva 10, Switzerland

Tel: (+41 22) 917 27 78

Fax: (+41 22) 917 03 09

E-mail: [email protected]

Website: http://www.unece.org/ead/ead_h.htm

|

In order to provide you

with a better service, we would appreciate it if you would send a copy of your

article to: Information Unit, United

Nations Economic Commission for Europe (UN/ECE), Palais des Nations, Room 356, CH - 1211

Geneva 10, Switzerland,

Tel: +(41 22) 917 44 44, Fax: +(41 22) 917

05 05,

E-mail: [email protected],

Website: http://www.unece.org

Thank you. |